THE RETURN TO A “NEW NORMAL” DEMANDS CHANGE

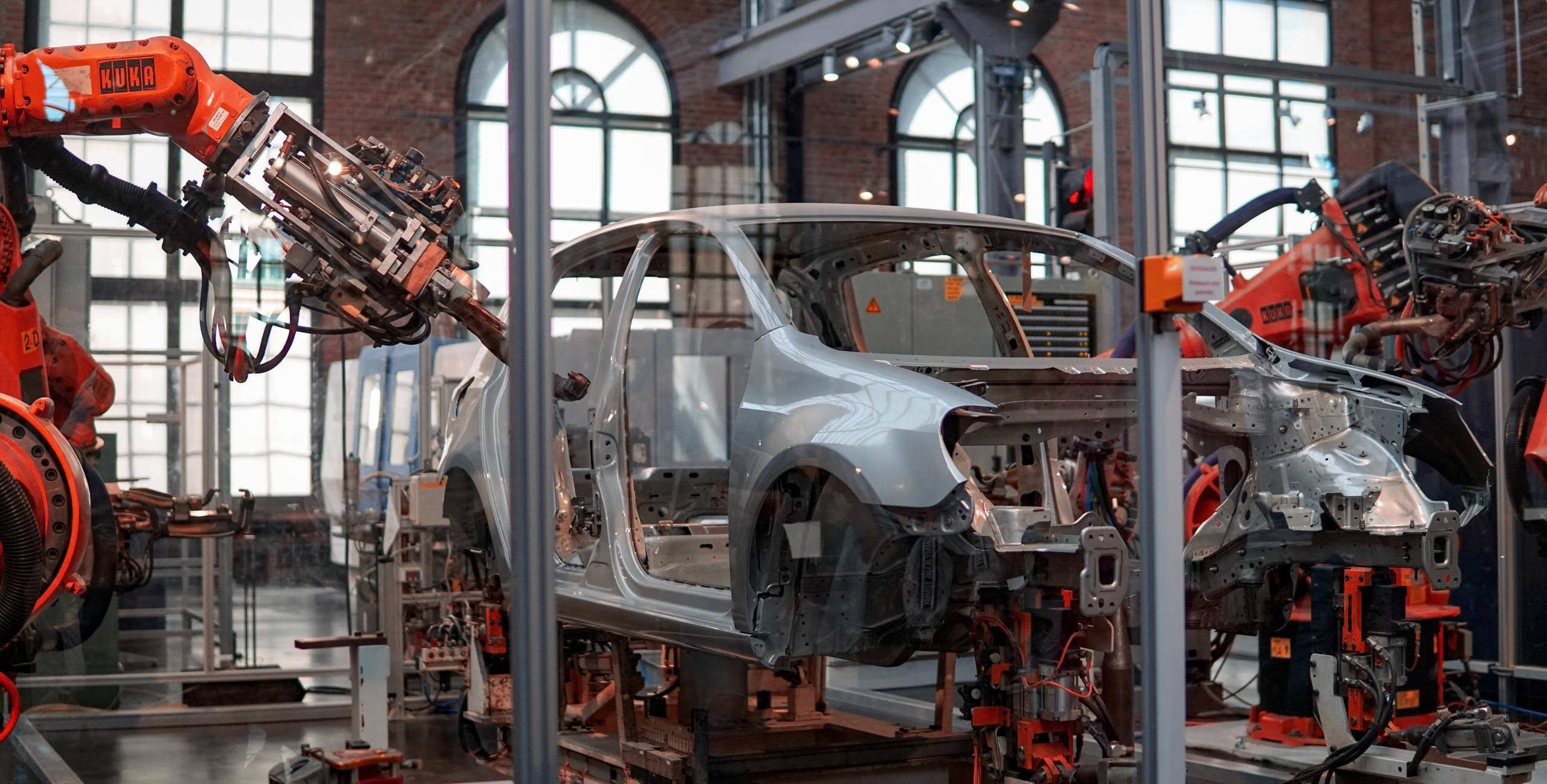

Purchasing managers’ indices worldwide have shown a high focus within the manufacturing sector, but this has diminished noticeably in the current climate. The fact that the expansion of production cannot keep pace with the increase in orders, is mainly due to extended delivery times of raw materials, input materials and the associated sharp rise in costs. Shortages of materials and limited transport capacities further exacerbate the supply chain bottlenecks that have existed for some time. So, stockpiling of primary material within warehouses is becoming common place but this creates more costs and passing them on in order to secure margins I becoming more difficult. Another issue is that for many companies, qualified and available employees can no longer be found in sufficient numbers, when needed.

Based on the general conditions at the end of the 1st half of 2021, Syngroup summarises the challenges that are currently having a significant influence on the economic development of the industry. Walter Woitsch, Managing Director at Syngroup is responsible for the operational development of the business units. Utilizing his extensive knowledge based upon his experience gained within a multitude of successful projects with some of the World’s leading businesses and further discussions with some of their board members, he paints an honest and realistic picture of the current situation for orientation purposes.

Challenge 1

Ensure availability of raw materials & intermediate products & pass on price increases to the customers

Challenge 2

Slowdown of positive productivity development – due to production expansions, supply chain bottlenecks and staff shortages – decelerate

Challenge 3

In (people) management, making decisions for the future, based upon multiply changes to the working policy and creating a new-look future

Challenge 4

Keeping an eye on the megatrends – sustainability, footprint, mobility shift, etc.

Challenge 5

Focus on sales – repositioning business development in the new customer business arena, after this almost came to a standstill in 2020/21 due to the crisis

In order to be able to implement the right optimisational measures, during ongoing operations and doing it in a timely manner, fact-based guidelines are required.

“There is a lot of talk about building digital twins in the area of operations –

in fact, we are still working in sub-areas without transparency and thus

without a factual basis for decision-making”

COO, Plastics Industry

As long as production is not slowed down by limited availability of raw materials or input materials, many of our customers are working at their capacity limits. The utilisation of existing efficiency reserves currently means a multiplier for the result:

+ Additional margin with unchanged fixed cost burden

+ Capacity expansion without additional resource build-up

In order to move forward, decisions need to be made based upon hard facts and not reactive. Only transparency in all production parameters that are critical to success, allows management to implement targeted and precise optimisation measures. However, we see that currently less than 50% of industrial companies have this transparency. Efficiency is crucial, especially in times of high capacity utilisation, and must not be lost in the hectic pace of daily business.

The starting point is the creation of complete transparency across all operational processes, step by step. This results in the right activities for future digitalisation. Digitisation of non-standardised processes do not lead to the desired results.

Thinking about price transfers in a broader context – if possible

Wherever opportunities arise, the topic of price pass-through should be linked to optimisations within the framework of a networked supply chain. This can cushion proportional price increases and strengthen customer relationships (e.g. through VMI activities). If all options on the customer and supplier side have been exhausted (including specifications, alternative materials or suppliers, insourcing, partnerships, integration of the supply chain) – then the implementation of a tightly controlled action plan to achieve the agreed outcome is required. Prompt realisation of pricing transfers will be a decisive factor for the annual result in 2021.

The path to a new normal requires commitment from every key staff member

“You can’t manage a group in remote mode in the long run”

CEO, Packaging Industry

It requires intensive discussions with key employees about the current situation and upcoming priorities. Despite all the “attempts” to create a sense of normality, the last few months have been characterised by exceptional situations – high fluctuations in volumes, availability of raw materials and capacities have placed huge demands on the management. After one and a half years – often months within a home office, without direct contact – the return to “normality” is now taking place. Why not treat this new start as a fresh start, question the effectiveness of existing routines and implement changes now? The starting point is an intensive discussion with the staff about possible ideas for the “New Normal” and how it should look and work. In our experience, the power of change can be driven through key employees if they are given the appropriate empowerment, time and willingness to reform.

New Business Development: A Structured ramp-up instead of multiple reactive decisions

“I can’t build a customer relationship remotely”

CSO, Interior

In times of saturated markets, sales require the need to be emotive and to listen “between the lines” – a great challenge in the times of the pandemic, as our clients widely confirm. Especially in times of gradual opening, structure should now be embedded before the next phase of decision making:

+ Have the fields of action or framework conditions shifted?

+ Are the new business target areas in line with the strategy?

+ Have existing routines been checked for “restart” efficiency and effectiveness?

+ Does the balance of the current sales portfolio between existing customers and new business development stand up to scrutiny?

Industry is in the midst of a constant upswing. With support, especially from the dynamism of German industry, it is driving overall economic development. This is the time for managers to take the action and implement measures to use this “New Start” as the initial step for change.

Walter Woitsch will be happy to discuss your individual assessments with you.

walter.woitsch@syn-group.com