FOR INDUSTRY

Walter Woitsch: Yes, I have to take up the cudgels for industry. I think it will be important to find a moderate line here. Why? Even with all the productivity gains in industry, we still have a wage cost share of around 20 to 30%. And if we already have high wage agreements in the second year or perhaps in a subsequent year, this will have a dramatic effect on the overall cost development. I can already see clients approaching us today and saying, “With these increases, we will have a massive cost and competitive issue in 2025”.

Walter Woitsch: You mentioned it. We have a very close interlocking. We are competing with our companies in their offers in the joint German companies, and if we have a shift here over a longer period of time or in favour of Germany in that sense, that will have a very, very dramatic effect on competitiveness from my point of view, because I say we cannot become even better here now than we actually already are. And therefore this imbalance must be balanced out somewhere, otherwise it will represent a real locational disadvantage in the medium term.

Walter Woitsch: Yes, what we are seeing is a renaissance of the issue of personnel productivity: on the one hand, we are seeing very high increases in the area of personnel costs, coupled with very moderate, moderate growth or declining volumes. Tendencies that lead to this. How can we find approaches here, whether it is in the area of digitalisation, that automation is always gaining very strong momentum, because there are many, even smaller solutions that can actually represent optimisation here. Or working with artificial intelligence data in connection with staff productivity.

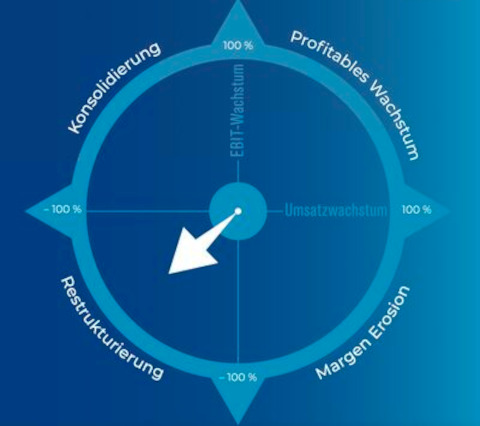

Walter Woitsch: I say conditionally it will. We have shown time and again in the past that the industry is very, very proactive here. And it certainly manages to maintain a high level. Coupled with this, I still see that IT is monitoring the entire portfolio. That is, how can we optimise margins here, perhaps also reduce certain areas or withdraw from certain business areas because they are simply no longer presentable due to this changed volume situation? Economically, that means that there are shifts in the business portfolios of the various industrial companies.

Walter Woitsch: It’s getting better, we can see it. I think the outlook is good for these six months. This year it’s going to be expensive, we’ll be through it and then we’ll see each other again next month. Then we will look at it.

Walter Woitsch: I believe in a good medium-term perspective, yes.